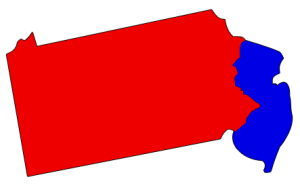

New Jersey changes course on reciprocity; Will remain in place with Pennsylvania

The Pennsylvania Department of Revenue announced this morning that it has been notified by the State of New Jersey that it will not terminate an 40-year old reciprocal tax agreement between the states.

The agreement allows Pennsylvania residents to work in New Jersey but not pay New Jersey state income tax. The same goes for a New Jersey resident working in Pennsylvania.

Consequently, New Jersey employers will continue to withhold and remit Pennsylvania tax on its Pennsylvania employees, while PA employers will do the same for NJ employees.

New Jersey had previously decided to end the arrangement during a budget and spending battle within its State Legislature.

Pennsylvania had been sending notices to employers with information about the change to help those businesses and individuals that would be affected could prepare for the change. Those notices can now be disregarded.

The agreement has been in place since 1977 and Pennsylvania notes it is pleased it will continue

Leave a Reply

Want to join the discussion?Feel free to contribute!